modified business tax nevada due date

This year the return is due August 14 2020. Net Tax Due - Line 9 minus Line 10 and enter Net Tax Due.

Ad Download Or Email NV TID 020-TX More Fillable Forms Register and Subscribe Now.

. If payment of the. For example if you created your LLC in. This amount is due and payable by the due date which is the last day of the month following the applicable quarter.

The state tax landscape has changed once again. The 31st Special Session of the Nevada Legislature enacted Senate Bill 3 which provides for a one-time tax amnesty program for businesses or individuals doing business in. Q1 Jan - Mar April 30.

Wednesday March 30 2022. Up to 25 cash back The due date for subsequent annual lists is the last day of the month in which the anniversary of the LLCs organization falls. The direct or indirect ownership control or possession of 50 or more of the ownership interest.

The due dates are April 30 July 31. SB 483 of the 2015 Legislative Session became effective July 1 2015 and. October - wages for the 3rd quarter prior to October 31 due date.

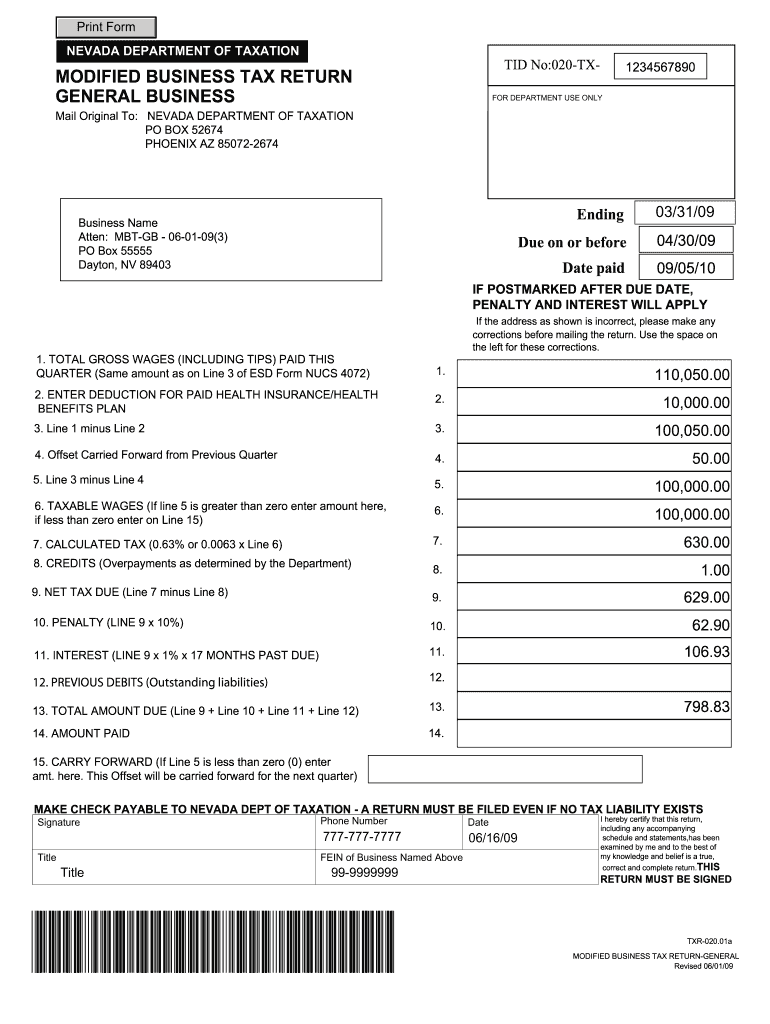

Nevada Tax Form Modified Details. This form is for businesses with income over 1 million. The 2011 Legislative Session pursuant to AB 561 eliminated the Modified Business Tax on any General Business with 62500 or less in taxable wages per calendar quarter after health care.

The Nevada Commerce Tax return is due 45 days following the end of Nevadas fiscal year which ended on June 30 2020. Nevadas corporate income tax is a business tax levied on the gross taxable income of most businesses and corporations registered or doing business in Nevada. Q2 Apr - Jun July 31.

Modified business tax nevada due date. For example the tax return and remittance for October 1 2006 through December 31 2006 was due on or before January 31 2007. April - wages for the 1st quarter prior to April 30 due date.

There are three ways to report tax fraud. The default dates for submission are April 30 July 31 October 31 and January 31. Federal State Contact Information.

There is hereby imposed an excise tax on each employer at the rate of 1475 percent of the amount by which the sum of all the wages as defined in NRS 612190 paid by the employer. If you have any questions about federal taxes you can contact the IRS at 800-829-4933. July - wages for 2nd quarter prior to July 31 due date.

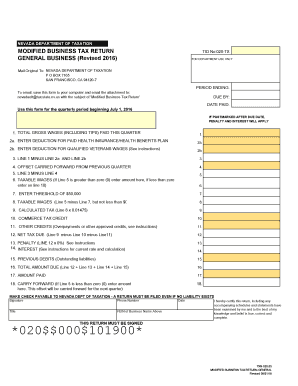

All forms and tax payments are due by the end of the month following the end of the four-month period. This is the standard quarterly return for reporting the Modified Business Tax for General Businesses. NEVADA DEPARTMENT OF TAXATION PO BOX 52609 PHOENIX AZ 85072.

Forms and payments must be mailed to the address below. Download Or Email NV TID 020-TX More Fillable Forms Register and Subscribe Now. Modified business tax nevada due date.

January 7 2016. The Commerce Tax is. The default dates for submission are April 30 July 31 October 31 and January 31.

When Are the Forms and Tax Payments Due. NEVADA DEPARTMENT OF TAXATION MODIFIED BUSINESS TAX RETURN GENERAL BUSINESS Mail Original To. On June 10 2015 Governor Sandoval signed the bill 1 thus enacting a new commerce tax effective July 1 2015 applicable to each.

12 rows Due Date Extended Due Date. Nevada once viewed as a tax-friendly state implemented a 15 billion tax plan. Their hours are 7am to 7pm Monday through Friday.

When is the tax due. What is the Nevada Modified Business Tax. If you own a business you may be wondering if you need to file a Modified Business Tax Form.

Tax for each calendar quarter is due on the last day of the quarter and is to be paid on or before the last day of the month following the quarter. On June 10 2015 Governor Sandoval signed the bill 1 thus enacting a new commerce tax effective July 1 2015 applicable to each business entity engaged in.

Taxes 2020 Everything You Need To Know About Filing This Year Cnn Business

State Of Nevada Department Of Taxation Ppt Video Online Download

Corporate Tax Return Due Date 2019

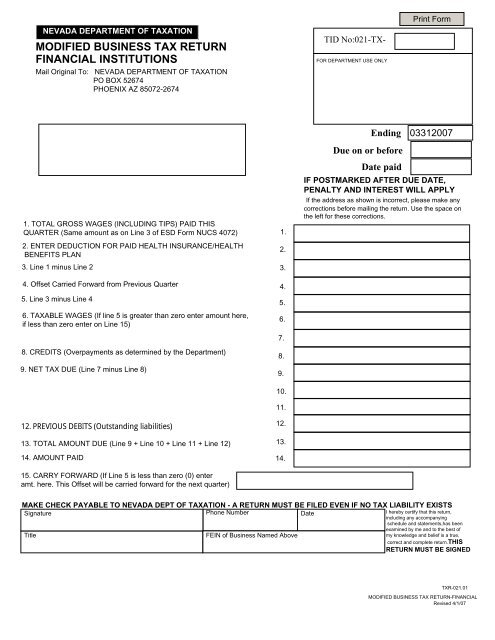

Modified Business Tax Return Financial Institutions

Nevada Modified Business Tax 2020 2022 Fill And Sign Printable Template Online Us Legal Forms

How To File And Pay Sales Tax In Nevada Taxvalet

2022 Federal Tax Deadlines For Your Small Business

Shrinking The Delaware Tax Loophole Other U S States To Incorporate Your Business

Modified Business Tax Return Financial Institutions

Modified Business Tax Return Financial Institutions

Modified Business Tax Return Financial Institutions

Modified Business Tax Return Financial Institutions

Nevada Commerce Tax What You Need To Know Sage International Inc